The Inflation Reduction Act made one of the largest climate investments in United States history, which means there’s the potential for real movement in many clean tech markets.

AJW staff have reviewed this ambitious piece of legislation and compiled the relevant provisions and helped identify opportunities for innovators.

But first, a little bit of background.

On July 27, 2022, Senators Chuck Schumer (NY) and Joe Manchin (WV) announced that they had reached a compromise agreement to move forward with a package that includes energy investments and tax incentives to support greenhouse gas emission reduction efforts. With swift action from Congress, President Biden signed the Inflation Reduction Act (IRA) into law on August 16, 2022.

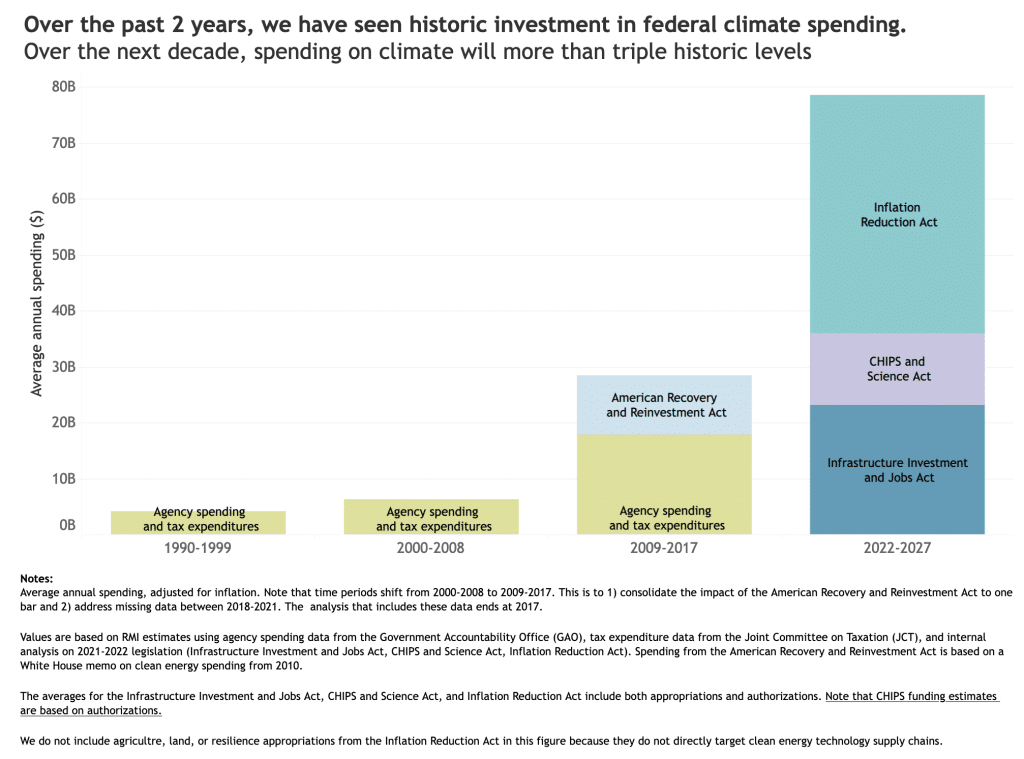

The IRA authorizes nearly $370 billion to stimulate the adoption of clean technologies and marks the largest climate action ever taken by the U.S. government – as the chart following clearly illustrates.[1] The bill was more than a year in the making and more guidance is still to come from the IRS, which will provide clarity and assistance for companies seeking to capture tax incentives.

[1] Shepard, Jun, “Federal Spending, 2009-2029.”

Coupled with the ongoing rollout of funding from the Infrastructure and Investment Jobs Act, the IRA will significantly affect clean energy and environment markets. Not only is the IRA expected to lower annual U.S. greenhouse gas emissions by 980 million metric tons of CO2-equivalent by 2030[1], but it will further:

- catalyze corporate climate action

- prioritize environmental justice

- increase engagement in voluntary carbon markets.

Read on for a brief summary of what’s included in the IRA.

Please reach out to Haley Armstrong for more information about any of these opportunities.

Tax Credits

- Extends and modifies the Sec. 48 ITC and PTC for clean energy property and generation

- Extends and modifies the Sec. 45(q) Carbon Sequestration tax credit

- Establishes Sec. 45(u) – Zero-Emission Nuclear Power PTC

- Establishes Sec. 45(y) – Clean Electricity PTC; and Sec. 48(d) – Clean Electricity ITC

- Extends Sec. 48(a) – Biodiesel Tax Credit; and Sec. 40(b) – Second Generation Biofuel Tax Credit

- Establishes Sec. 40(b) – Sustainable Aviation Fuel Tax Credit

- Establishes Sec. 45(v) – Clean Hydrogen Production Tax Credit

- Establishes Sec. 30(d) – Clean Vehicle Credit; Sec. 25(e) – Credit for Previously-Owned Clean Vehicles; and Sec. 45(w) – Credit for Qualified Commercial Clean Vehicles

- Extends Sec. 30(c) – Alternative Fuel Refueling Property Credit

- Establishes Sec. 45(z) – Clean Fuel Production Credit

- Extends Sec. 48(c) – Advanced Energy Project Credit

- Establishes Sec. 45(x) – the Advanced Manufacturing PTC

Additional Major Climate Programs

- $27 billion for a Greenhouse Gas Reduction Fund (“green bank”)

- $6 billion for Environmental and Climate Justice Block and Neighborhood Access and Equity Grants

- $235 million for Air Quality Monitoring Grants

- $250 million for GHG Air Pollution Planning Grants

- $4.75 billion for GHG Air Pollution Reduction Implementation Grants

- $3 billion to reduce air pollution at ports and $60 million to reduce diesel emissions at ports

- $250 million to EPA for carbon-intensity reporting for construction materials

- $500 million for the use of the Defense Production Act

- $6 billion for a new Advanced Industrial Facilities Deployment Program

- Establishes the Methane Emission Reduction Program

- Increases the Loan Programs Office’s authority to make commitments, and provides $75 million for the Tribal Energy Loan Guarantee Program and $3 billion for the Advanced Technology Vehicle Manufacturing program

[1] Jenkins, J.D., Mayfield, E.N., Farbes, J., Jones, R., Patankar, N., Xu, Q., Schivley, G., “Preliminary Report: The Climate and Energy Impacts of the Inflation Reduction Act of 2022,” REPEAT Project, Princeton, NJ, August 2022.