Q2 opened with sweeping tariff announcements and closed with the final push for the White House’s signature legislative package – signed into law as Q3 began.

Some analysts estimate that the “Big Beautiful Bill” will reduce energy transition investment by $500 billion during the next decade. Beauty, it seems, remains in the eye of the beholder.

Q2 was dense with sobering developments:

- Capital spending on energy projects slowed.

- Global multinationals reversed course on sustainability pledges.

- Funding for demonstration projects went into reverse.

While the energy transition is our focal point, the chill in investment extends further. The dollar has slipped 11% against major currencies. Tariff uncertainty persists. And economists increasingly warn of repercussions should the dollar lose its reserve currency status.

And that’s just North America.

Across Europe, the energy transition remains a political piñata. Clean energy skeptics captured a presidency (Poland) and cheered a government’s fall (Netherlands). In both cases, as in the U.S., asylum and immigration were catalytic issues. Climate initiatives are collateral damage.

We needn’t go on. But acknowledging the wreckage gives perspective to the cheerfulness below.

The setbacks are real – but won’t reverse the momentum.

We aim to counter the gloom with a dispassionate look at the data – and more than a few reasons for continued optimism.

Consider the following:

- Policy clarity is underrated. With the reconciliation bill complete, investors now have a clear picture of the tax landscape – allowing some delayed projects to resume.

- The $500B headline? Context matters. That estimate assumes $50 billion per year – just a 0.25% hit to the $2 trillion in annual global clean energy investment – not trivial, but far from catastrophic.

- Clean energy isn’t standing still. In 2024, global wind and solar capacity expanded by 18% – nine times the growth rate of fossil fuel production (Statistical Review of World Energy). The IRA didn’t cause that growth; its rollback won’t halt it. Supply chains will shift – but demand for financially sound climate de-risking is on the rise.

- Our global energy appetite is growing. AI infrastructure is a partial driver, but the broader surge in demand makes the case for renewables more compelling, especially given the siting, permitting, and cost hurdles for fossil development.

- Security concerns favor clean energy. From Brussels to Tokyo, energy self-sufficiency is now a national priority. And in many jurisdictions, domestic production means wind, solar, and storage – not oil and coal.

- ESG isn’t dead – it’s maturing. While the “virtue signaling” era has been waning for some time, sound ESG projects that deliver economic value continue to attract capital.

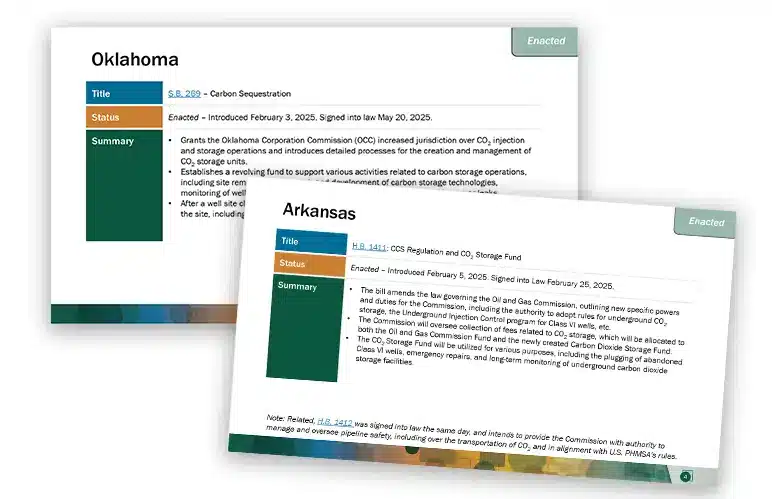

- Policy Marches On. Policy support for climate action is expanding in the EU, UK, Canada, and even in US states: Iowa adopted a SAF tax credit, Illinois is considering a clean fuel standard, and Arkansas and Oklahoma are promoting carbon sequestration.

AJW provides clients with the actionable market and policy intelligence they need to protect their bottom lines.

Market fundamentals outweigh government incentives

The transition to clean energy is not a mirage propped up by subsidies. Clean energy investment continues to outpace fossil energy investment by a wide margin. If global energy investment (sitting around $3.3 billion annually) were its own economy, it would be the 6th largest GDP on Earth with two-thirds of that aimed at decarbonizing solutions.

Two implications follow:

- The positive and negative effects of U.S. policy shifts are modest in global terms.

- The market – not government largesse – is driving decarbonization, albeit within a policy-defined framework.

Surveys of climate investors confirm the trend.

- 80% report maintaining or increasing clean energy commitments despite U.S. policy reversals.

- 56% are increasing their focus on “policy-proof” investments to mitigate regulatory risk.

Meanwhile, Germany, France, and the UK added a combined 7.5 GW of renewable capacity in 2024 while renewable power is overtaking fossil generation in Spain, Italy, Greece and elsewhere, while enjoying falling energy costs. Their motivation is pragmatic: resilience, energy security, and cost-effectiveness.

Fossil projects compete with economically viable clean alternatives. When total cost of electricity (TCOE) and operational resilience are factored in, renewables often win. Moreover – as energy demand outpaces capacity additions, market metrics switch from TCOE toward total return on electricity (TROE) analysis, making it even more attractive to go green.

A contrarian view? Sure – but we are in good company.

In our Q1 note, we argued that momentum toward decarbonization is increasingly difficult to reverse. We’re not alone. Evidence continues to mount.

For instance, Generate Capital’s view underscores the continued appeal of clean infrastructure projects with a long-term payoff. (Kudos to Ben Geman ’s newsletter Axios Generate for highlighting fellow travelers on our sunny side of the street).

What’s an innovation investor to do?

It remains true that one’s assessment of this moment depends on where one sits.

Fossil fuel use continues to grow—particularly coal in China. From a climate perspective, that’s bad news.

Still, it’s necessary to acknowledge that this transition was never going to follow the aspirational curve drawn by hopeful slide decks. Clean energy citing and permitting also face challenges. The IRA rollback is a blow—but far from fatal.

Business models built around maximal Biden-era spending are now exposed. Perversely, the biggest beneficiaries of IRA rollback may be clean tech manufacturers outside the U.S., including some whose production methods are problematic from sustainability and ethical perspectives, e.g., Chinese solar panel manufacturers, and exploitative critical mineral extraction.

Global demand for solar panels and other renewable power basics will not be materially influenced by the “Big Beautiful Bill.” But the repeal of tax credits that promoted US manufacturing will leave global customers with few options but to stay with the current low-cost supplier. At least with regard to the energy transition supply chain, the change in US policy will promote job growth outside the US rather than in the states.

But don’t miss that the energy transition has an increasing alignment of economic, security, and sustainability objectives. Projects that move forward now do so because they make economic sense – and they advance net-zero goals. This alignment is not a footnote. It’s trending toward a tipping point after which global business becomes a structural force behind decarbonization.

Witness the pivot in the petroleum sector now actively wrestling with the challenge of returning shareholder value without inviting further climate liability. American Clean Power Association (ACP) CEO Jason Grumet – looking to move quickly past IRA setbacks – put it well: we are seeing the rise of a “coalition of the pragmatic.”

Some might see those as strategic pivots. We sense a powerful trend.

AJW Quarterly Series: Finding Calm in the Chaos

A quarterly review of global forces across the energy transition, seeking the signal amidst the noise.

AJW is wading into the conversation because we see the upside in discerning the difference between caution and fear. We make no claim to clairvoyance – merely some hard-won insights, drawn from setbacks as well as successes during decades of working with dedicated and resilient energy leaders. We aim to help those seeking resilience, not retreat.

To learn more about our work – and to gain an experienced partner tested in the crucible of energy transition turbulence – visit https://ajw-inc.com/.